Lotus Loan - Sri Lanka

Category: Finance Date:2023-10-10

Rating: 4.4

Introduction

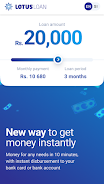

Lotus Loan is an online loan service in Sri Lanka that provides a seamless and hassle-free borrowing experience. With their user-friendly mobile application, borrowers can apply for loans anytime, anywhere, without the need for physical visits to banks or lenders' offices. They provide clear information about loan terms, fees, and repayment schedules, ensuring transparency before accepting a loan. The loan product range is from RS 10,000 to RS 80,000, with a loan term of 92-180 days and an interest rate of up to 12% (Max APR = 12.0% per year). Lotus Loan emphasizes regular monthly payments and does not require the loan to be paid off within 92 days. To be eligible for the loan, applicants must be Sri Lankan citizens aged over 22 with a bank account and a stable income. For inquiries, customers can contact their Customer Service & Support Center during their operating hours of 8:30 am to 5:30 pm.

The six advantages of LotusLoan are:

- Seamless and hassle-free borrowing experience: LotusLoan provides an online loan service that allows borrowers to easily apply for loans anytime, anywhere, without the need for physical visits to banks or lenders' offices.

- Convenient accessibility: The platform offers a user-friendly mobile application, making it easy for borrowers to access and apply for loans.

- Clear information about loan terms, fees, and repayments: LotusLoan provides transparent information about loan terms, fees, and repayment schedules, allowing borrowers to understand the details of their loan before accepting it.

- Flexible loan options: The loan amount ranges from RS -000 to RS -- with a loan term of 92 to 180 days. The interest rate can go up to 12% (Max APR = -0% per year) for all loans advised by LotusLoan.

- Example loan calculation: The content provides an example loan calculation, including the loan amount, loan period, consulting fee, service fee, and interest rate, to give borrowers an idea of the total payment they can expect.

- Minimal loan repayment period: Customers are allowed to make regular monthly payments and are not required to pay off the loan within 92 days. This flexibility provides borrowers with more convenience in managing their loan repayments.

- No virus

- No advertising

- User protection

Information

- File size: 44.00 M

- Language: English

- Latest Version: v0.0.7

- Requirements: Android

- Votes: 78

- Package ID: com.lotusloanmobile