Introduction

Are you considering taking out a loan but unsure of the cost and monthly repayments? Look no further than Loan Simulator! This innovative app allows you to effortlessly calculate the value of your monthly fee, helping you budget and plan ahead. With its intuitive interface, Loan Simulator also generates an amortization schedule, ensuring you have a clear understanding of your loan's progress. But that's not all! This app goes the extra mile by totaling the value of the interest paid, giving you a comprehensive overview of the financial commitment you're about to make. Take control of your finances with Loan Simulator today!

Features of Loan Simulator:

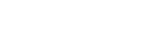

* Loan Calculator: The app allows you to accurately calculate the value of the monthly fee for your loan. Simply input the loan amount, interest rate, and repayment term, and the app will instantly provide you with the monthly repayment amount. This feature is incredibly useful when you want to determine whether you can comfortably afford the loan or if you need to adjust the loan amount or repayment term.

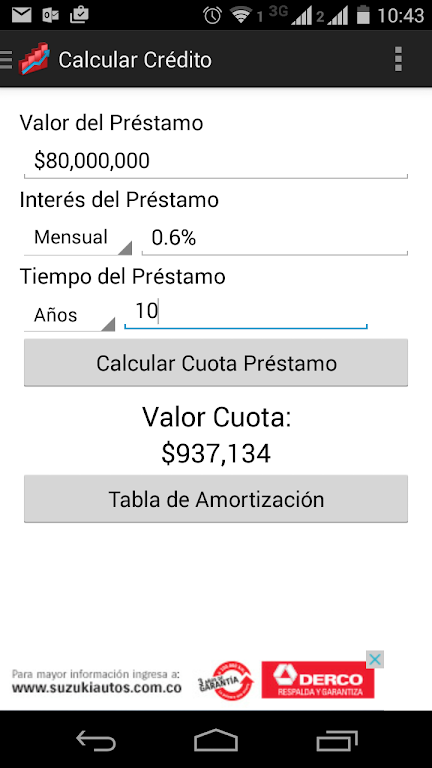

* Amortization Table: With the app, you can generate an amortization table that breaks down each monthly payment into principal and interest. This table provides a clear overview of how your loan balance decreases over time and how much of each payment goes towards reducing the principal amount and paying off the interest. By understanding the amortization schedule, you can make more informed decisions about your loan.

* Interest Calculation: A crucial feature of the app is its ability to calculate the total value of the interest paid over the loan's term. By inputting the loan amount, interest rate, and repayment term, the app can accurately calculate the total interest amount you will pay over the life of the loan. This feature allows you to evaluate different loan options and choose the one that minimizes your interest payments.

Tips for Users:

* Adjust the Loan Parameters: Play around with different loan parameters such as loan amount, interest rate, and repayment term to see how they affect the monthly payment and total interest paid. This will help you find the most favorable loan terms for your financial situation.

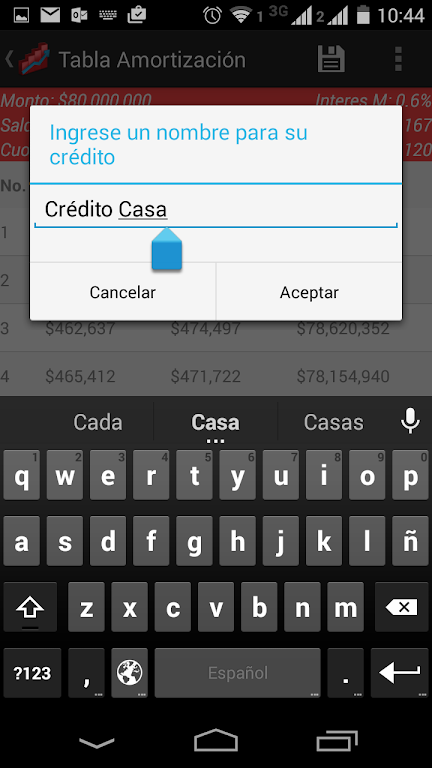

* Compare Different Loan Options: Use the Loan Simulator app to calculate the costs and monthly payments of different loan options. By comparing multiple loan offers, you can find the most advantageous terms and save money in the long run.

* Plan for Extra Payments: If you have the ability to make additional payments towards your loan, use the app to estimate how much you can save in interest and shorten the loan term. Paying off your loan faster can help you become debt-free sooner and save you money on interest payments.

Conclusion:

The Loan Simulator app is a powerful tool for anyone considering taking out a loan. With its user-friendly interface and comprehensive features, you can accurately calculate the monthly fee, generate an amortization table, and determine the total interest paid. By utilizing the app's playing tips, you can make informed decisions about your loan, compare different options, and potentially save money in the long run. Whether you're planning to take out a mortgage, car loan, or personal loan, the Loan Simulator app will help you navigate the financial aspects and ensure you choose the right loan for your needs.

- No virus

- No advertising

- User protection

Information

- File size: 10.20 M

- Language: English

- Latest Version: 3.9

- Requirements: Android

- Votes: 171

- Package ID: com.cristhian.calculadorcredito

- Developer: Cristhian Salazar

Screenshots

Explore More

Take control of your money with our powerful finance apps. Track spending, create budgets, and set savings goals using our easy-to-use tools. Invest wisely by accessing real-time market data and analyst reports. Manage portfolios and optimize taxes for greater returns. Apply for loans, credit cards, and insurance with our partners for personalized rates. Securely link accounts for a consolidated view of your finances.

Mujer Financiera

Final Cepte

EG Mobile

Oberbank

BCB Bank

Easypaisa

Astrology: My Daily Horoscope

Accounting Basics