Introduction

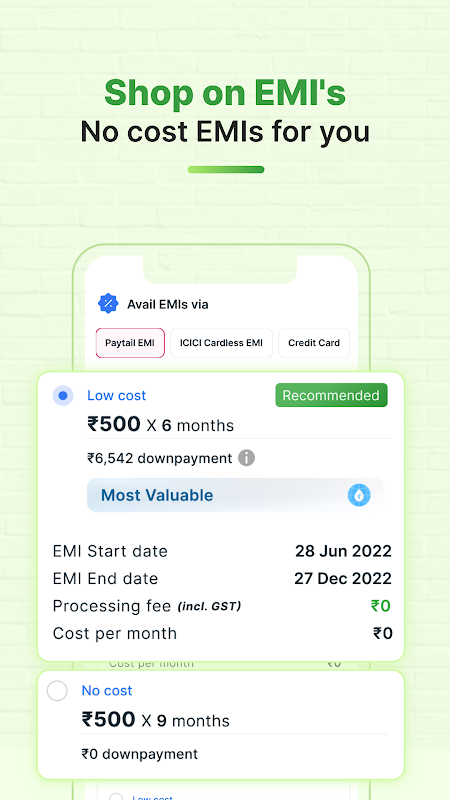

Introducing Paytail - Buy on easy EMIs - the ultimate finance app for all your shopping needs! With Paytail, you can shop at nearby merchant stores and enjoy the convenience of easy EMIs along with exciting cashback offers. Need financial assistance for your purchases? Paytail has got you covered with their instant line of credit, Paytail EMI, offered through their trusted partner lending institutions. Whether you're looking for a small loan of Rs. 3,000 or a larger amount of Rs. 500,000, Paytail has flexible loan options for you. With loan tenures ranging from 3 to 18 months and competitive interest rates starting from 18% per annum, you can easily manage your repayments. Partnered with Cholamandalam Investment and Finance Company Limited, Paytail ensures reliability and transparency in their services. So why wait? Unlock a world of hassle-free shopping and finance your dreams with Paytail today!

Features of Paytail - Buy on easy EMIs:

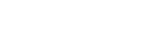

Easy Finance Options: Paytail offers a convenient and hassle-free way to finance your shopping needs. With Paytail EMIs, eligible members can get instant loans to make their purchases more affordable.

Wide Range of Loan Amounts: Whether you need a small loan for a quick purchase or a larger loan for a bigger expense, Paytail has you covered. The minimum loan amount is Rs. 3,000 and the maximum loan amount is Rs. 500,000, giving you the flexibility to choose the amount that suits your needs.

Flexible Loan Tenure: Paytail understands that everyone's financial situation is different. That's why they offer a range of loan tenures, varying from 3 months to 18 months. You can choose the repayment period that works best for you and manage your finances accordingly.

FAQs:

How can I apply for a Paytail loan?

To apply for a Paytail loan, simply download the app, register as a user, and follow the application process. Eligible members will be offered instant loans through Paytail's partner lending institutions.

What are the eligibility criteria for a Paytail loan?

The eligibility criteria for a Paytail loan may vary depending on the specific lending institution. Generally, you must be a registered Paytail user and meet certain income and credit score requirements.

How long does it take to get approved for a Paytail loan?

With Paytail's instant line of credit, eligible members can get approved for a loan within minutes. The application process is quick and streamlined, allowing you to make your purchases without delay.

Are there any additional fees associated with Paytail EMIs?

Paytail does not charge any additional fees for their EMIs. You only need to pay the monthly EMI amount, which includes the principal loan amount and the interest charges.

Conclusion:

With easy finance options, a wide range of loan amounts, flexible repayment tenures, and competitive interest rates, Paytail - Buy on easy EMIs makes it convenient for users to shop and finance their purchases. The app provides a hassle-free application process and instant loan approval, allowing users to make their purchases without delay. Whether you need a small loan or a larger one, Paytail has you covered. Its transparent pricing and no additional fees make it a reliable choice for all your shopping needs.

- No virus

- No advertising

- User protection

Information

- File size: 25.40 M

- Language: English

- Latest Version: 7.4.0

- Requirements: Android

- Votes: 482

- Package ID: com.paytail.consumers

- Developer: Paytail Commerce Private Limited

Screenshots

Explore More

Dive into an extraordinary shopping journey with our cutting-edge, globally-available mobile application. Tailored to your preferences, it offers a seamless, personalized shopping experience at your fingertips. Enjoy exclusive deals, compare prices, and check product reviews with ease. Secure, fast, and user-friendly, it's your ultimate shopping companion. Transform your shopping routine - download now!

YH Yue Yue Club

Bazaar

Mezi's

RewardX

Qwintry

Landfleischerei Töpfer

Żabka Jush

Соседи — всегда под рукой