Introduction

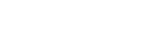

Introducing Kmobimn, the ultimate online loan application that offers a range of benefits to cater to your everyday needs. With its user-friendly design and time-saving features, this app is here to revolutionize the loan application process. Say goodbye to the hassle of gathering voluminous paperwork as the app requires no collateral and ensures a seamless experience. What sets the app apart is its unparalleled convenience - you can access credit anytime, anywhere, 24/7. With long-term loan options of up to 90 days and a generous maximum loan amount of 10,000,000₮, the app empowers you to meet your financial goals. Additionally, with the Q-Pay feature, you can easily repay your debts and progressively increase your loan limit. Sign up online and activate your account to freely enjoy our loaning services via messages. With the app, managing your finances has never been easier!

Features of Kmobimn:

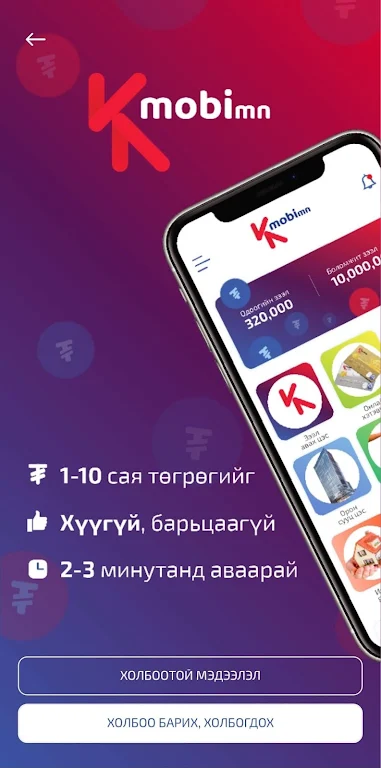

* Personal Loans with Flexible Periods: Kmobimn offers personal loans with a choice of repayment periods of 75 or 90 days. This allows you to customize the loan duration according to your financial needs and repayment capacity.

* No Collateral Required: Unlike traditional loan applications, the app does not require any collateral to secure your loan. This eliminates the hassle of gathering and submitting extensive paperwork, making the loan application process quicker and more convenient.

* 24/7 Accessibility: With the app, you can apply for a loan anytime, anywhere. The app operates round the clock, giving you the freedom to access credit services at your convenience, without being bound by distance or time limitations.

* High Loan Amount: Kmobimn provides a high loan amount of up to 10,000,000₮, allowing you the flexibility to borrow a substantial sum to meet your financial requirements.

Tips for Users:

* Plan Your Repayment Schedule: Before applying for a loan on the app, it is important to consider your repayment capacity. Create a budget and determine how much you can comfortably repay each month. This will help you choose the right loan amount and repayment period that aligns with your financial situation.

* Use Q-Pay for Debt Payment: Kmobimn offers the convenience of using Q-Pay to settle your debts. Take advantage of this feature to streamline your debt management process and ensure timely repayments.

* Sign Up and Activate for Messaging Services: After signing up and activating your account, you can enjoy the convenience of accessing loan services through messages. This eliminates the need for repeated app logins and allows you to effortlessly request additional loans whenever needed.

Conclusion:

With its flexible loan periods, high loan amounts, and 24/7 accessibility, it provides a convenient solution to meet your everyday financial needs. By following the playing tips, such as planning your repayment schedule and using Q-Pay for debt payments, you can make the most of Kmobimn and efficiently manage your finances. Sign up today and experience the convenience and flexibility of the app for your loan requirements.

- No virus

- No advertising

- User protection

Information

- File size: 60.90 M

- Language: English

- Latest Version: 3.0.0

- Requirements: Android

- Votes: 410

- Package ID: com.kmobi

- Developer: Central Capital

Screenshots

Explore More

Take control of your money with our powerful finance apps. Track spending, create budgets, and set savings goals using our easy-to-use tools. Invest wisely by accessing real-time market data and analyst reports. Manage portfolios and optimize taxes for greater returns. Apply for loans, credit cards, and insurance with our partners for personalized rates. Securely link accounts for a consolidated view of your finances.

Mujer Financiera

Final Cepte

EG Mobile

Oberbank

BCB Bank

Easypaisa

Astrology: My Daily Horoscope

Accounting Basics