Introduction

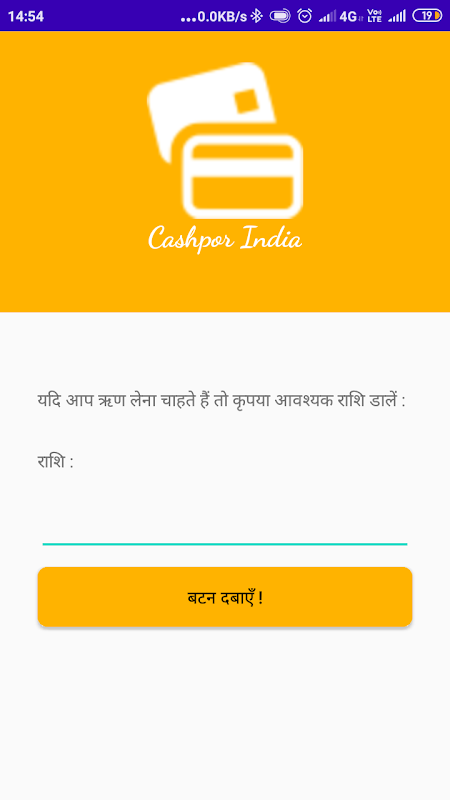

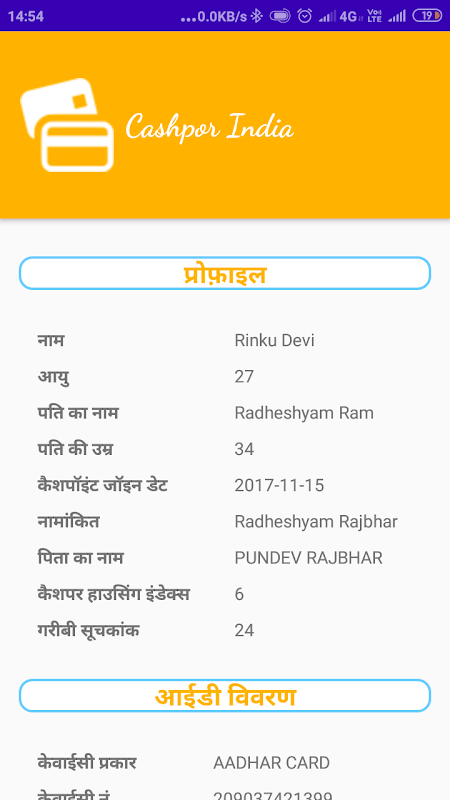

Cashpor India is the ultimate mobile tool for members of Cashpor Micro Credit. With this app, members can easily access important information and perform various tasks. The profile module provides a comprehensive overview of the member's personal details, such as their name, age, spouse's name and age, joining date, nominee name, father's name, Cashpor Housing Index, PPI score, KYC type, KYC number, address, and contact details of the regional and branch managers. Furthermore, members can view all their active loan details, including loan disbursement date, amount, principal due, installment amounts and dates. The app also offers a convenient loan application module and a direct line to the client grievance cell. Stay connected and manage your finances with ease using the app.

Features of Cashpor India:

- Comprehensive Profile Module: The app provides a detailed profile module, offering clients easy access to essential information such as their own details, spouse details, joining date, nominee information, and more. This comprehensive profile allows members to have all their relevant information in one place, making it convenient and efficient.

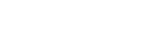

- Loan Details at a Glance: The app enables members to access all active loan details in one place. It includes important information like loan disbursement date, principal due, installment amounts, loan type, and due dates. Having all this information readily available allows members to stay on top of their loan repayments and manage their finances effectively.

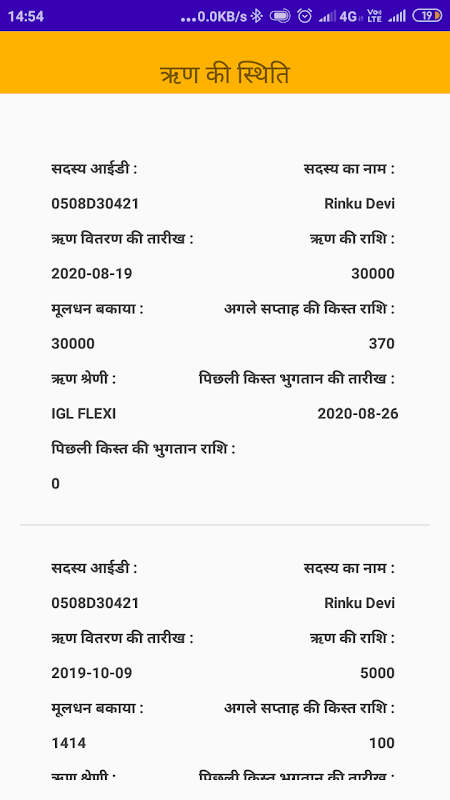

- Convenient Loan Application Process: With the app, members can easily apply for a new loan through the dedicated loan application module. Once the application is submitted, a unique Loan Request ID is generated, and members can track the progress of their loan request by referencing this ID. This streamlined process saves time and makes loan applications hassle-free.

- Quick Access to Client Grievance Cell: In the Client Grievance module of the app, members can find the contact information for the Client Grievance Cell. This feature provides a direct line of communication for members to address any concerns or issues they may have, ensuring prompt resolution and enhanced client satisfaction.

Tips for Users:

- Keep Your Profile Updated: Regularly check and update your profile information to ensure that all details, such as spouse information and address, are accurate. This will help you stay organized and have the most up-to-date information in one place.

- Set Reminders for Loan Installments: Take advantage of the loan details section to set reminders for upcoming installment due dates. This will help you stay on top of your loan repayment schedule and avoid any late payment penalties.

- Utilize the Loan Request ID: When applying for a new loan, make note of the unique Loan Request ID generated. This ID will allow you to easily track the progress of your loan request and gather any additional information related to it.

Conclusion:

With a comprehensive profile module, detailed loan information, easy loan application process, and direct access to the client grievance cell, this app simplifies the financial management experience for members. By regularly updating their profile, setting reminders for loan installments, and utilizing the Loan Request ID, members can optimize their experience and make the most of the app's features. Download Cashpor India today and take control of your microcredit account effortlessly.

- No virus

- No advertising

- User protection

Information

- File size: 2.60 M

- Language: English

- Latest Version: 1.1

- Requirements: Android

- Votes: 149

- Package ID: com.cashpor.cashporpay

- Developer: Anjan Kumar Kar

Screenshots

Explore More

Take control of your money with our powerful finance apps. Track spending, create budgets, and set savings goals using our easy-to-use tools. Invest wisely by accessing real-time market data and analyst reports. Manage portfolios and optimize taxes for greater returns. Apply for loans, credit cards, and insurance with our partners for personalized rates. Securely link accounts for a consolidated view of your finances.

Mujer Financiera

Final Cepte

EG Mobile

Oberbank

BCB Bank

Easypaisa

Astrology: My Daily Horoscope

Accounting Basics