Introduction

Introducing FlexPay: Personal Loan App, the ultimate solution for all your personal loan needs. With it, you can say goodbye to the hassle and lengthy paperwork that comes with traditional loans. This innovative app offers you an instant credit line and personal loan of up to 3 lakhs, all at your fingertips. Whether you need some extra cash for groceries, food, medicines, or even a bike service, FlexPay has got you covered. The application process is simple and quick, and if you meet the eligibility criteria, you'll receive the funds in your bank account on the same day. No more waiting around for approvals or dealing with complex procedures. FlexPay aims to be the most user-friendly personal loan app in India, allowing you to enjoy a stress-free and convenient borrowing experience. So why wait? Download FlexPay now and experience the future of personal lending.

Features of FlexPay: Personal Loan App:

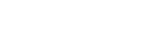

- Instant Credit Line: FlexPay offers customers a credit line of up to 3 lakhs instantly. This allows users to have access to funds whenever they need it, without the hassle of traditional loan applications.

- Simple and Quick Loan Application Process: With FlexPay, applying for a loan is easy and convenient. Users can complete the entire process online, eliminating the need for paperwork and lengthy approval processes.

- Scan-Now Pay-Later Option: FlexPay provides users with the option to scan a QR code and make payments later. This feature allows users to make purchases without having to worry about immediate payment, making it ideal for emergencies or unexpected expenses.

- User-Friendly Interface: FlexPay aims to be one of the most user-friendly personal loan apps in India. The app is designed with a clean and intuitive interface, making it easy for users to navigate and access their loan information.

Tips for Users:

- Use the Credit Line Wisely: FlexPay: Personal Loan App provides users with a credit line that can be used for various purposes. It is important to use this credit wisely and only for necessary expenses. Avoid using the credit line for frivolous purchases to ensure financial stability.

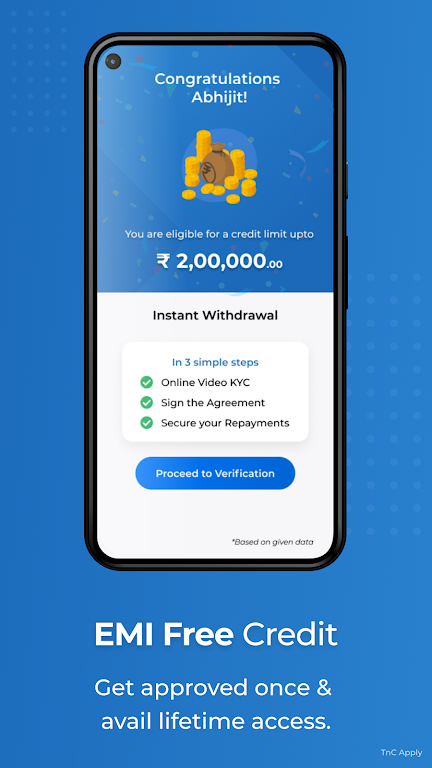

- Make Timely Payments: To maintain a good credit score and avoid any penalties, it is essential to make timely payments on your FlexPay loan. Set reminders or enable auto-debit to ensure that your payments are made on time.

- Take Advantage of the Scan-Now Pay-Later Option: The Scan-Now Pay-Later feature offered by FlexPay is a convenient way to make immediate purchases and pay later. Use this option when necessary, but be mindful of your repayment schedule to avoid accumulating debt.

Conclusion:

With its simple and quick loan application process, users can easily access funds for their immediate needs. The Scan-Now Pay-Later option provides flexibility in making payments, while the user-friendly interface ensures a seamless experience. By using the credit line wisely and making timely payments, users can effectively manage their finances and improve their financial health. Download FlexPay: Personal Loan App today to experience the convenience and flexibility it offers.

- No virus

- No advertising

- User protection

Information

- File size: 34.50 M

- Language: English

- Latest Version: 4.9

- Requirements: Android

- Votes: 426

- Package ID: in.india.upi.flexpay

- Developer: VIVIFI - Instant Personal Loan & Online Loan App

Screenshots

Explore More

Take charge of your wellbeing with our innovative health and fitness apps. Monitor your activity, sleep, nutrition and more using our advanced tracking tools. Access personalized insights to develop healthy habits. Check symptoms, manage medications, and connect with doctors through our telehealth services. Follow customized workout plans for any fitness level with our virtual coaching.

OCTAVE

Mujer Financiera

Fastyle

Final Cepte

Astromatik

Moeve

Kegel Men: Men's Pelvic Health

Psychological concepts