Introduction

Say hello to Kopa Kash, the app that's here to help you grow. With it, you can easily get a business loan today. No more endless paperwork or waiting in long lines. This user-friendly app works just like other popular platforms such as Branch, Timiza, Okash, Inuka, Okolea, and Fuliza. So why wait? Take action now and give the app a try. Say goodbye to financial constraints and hello to the future of your business. Download it today and unlock your business's true potential.

Features of Kopa Kash:

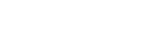

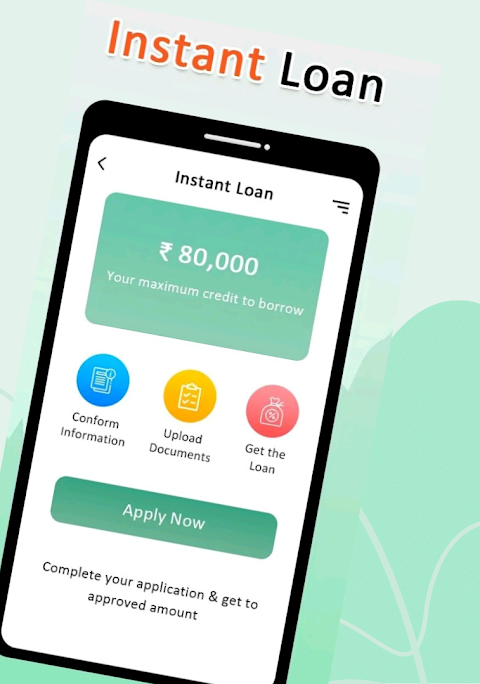

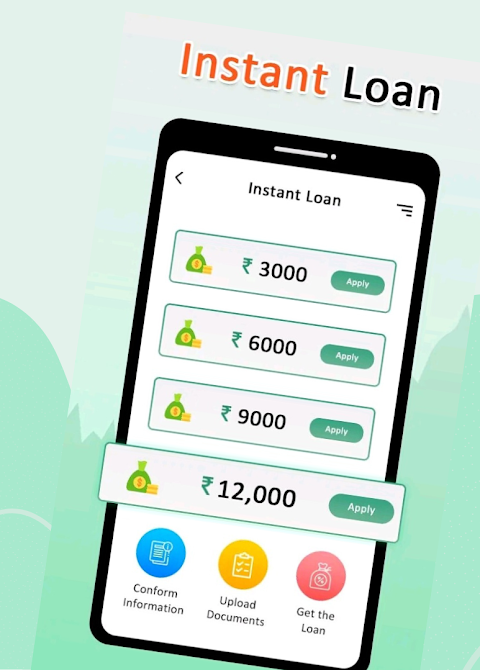

- Quick and Convenient Loan Approval: KopaKash provides small businesses with a speedy and hassle-free loan approval process. With just a few taps on your phone, you can apply for a loan and get approved within minutes. No more lengthy paperwork or waiting in long queues at the bank.

- Flexible Repayment Options: Unlike traditional loans, KopaKash offers flexible repayment options tailored to your business's needs. You can choose the repayment period that suits you best, whether it's weekly, bi-weekly, or monthly. This flexibility ensures that you can manage your cash flow effectively and comfortably repay your loan.

- Competitive Interest Rates: KopaKash understands the needs of small businesses and offers competitive interest rates. By keeping the interest rates affordable, they aim to support your business's growth without burdening you with excessive costs. This makes KopaKash a more attractive choice compared to other loan providers.

- Easy Access to Funds: Once your loan application is approved, KopaKash ensures quick disbursal of funds directly into your business account. This means you can have immediate access to the funds you need for inventory purchases, equipment upgrades, or any other business expenses. No more waiting for days or weeks to receive the loan amount.

Tips for Users:

- Complete the Application Thoroughly: To increase your chances of getting approved for a loan, make sure to provide all the necessary information accurately and thoroughly. Missing or incomplete details may delay the approval process, so take your time to fill in the application form carefully.

- Calculate Your Repayment Capacity: Before applying for a loan, assess your business's cash flow and determine how much you can comfortably repay. Use KopaKash's flexible repayment options to choose a suitable plan that aligns with your financial capabilities. It's essential to ensure that your business can handle the loan repayment without straining your finances.

- Plan Ahead: Identify the purpose of the loan and create a detailed plan on how you intend to utilize the funds. Whether it's investing in new equipment, expanding your inventory, or marketing campaigns, having a well-thought-out plan will not only help you make the most of the loan but also showcase your business's growth potential to KopaKash.

Conclusion:

By following the playing tips, applicants can maximize the chances of loan approval and strategically utilize the funds to fuel business growth. Whether you need funds for operational expenses or expansion plans, Kopa Kash offers a user-friendly platform to fulfill your financial needs. Take action today and explore the benefits of KopaKash for your small business's success.

- No virus

- No advertising

- User protection

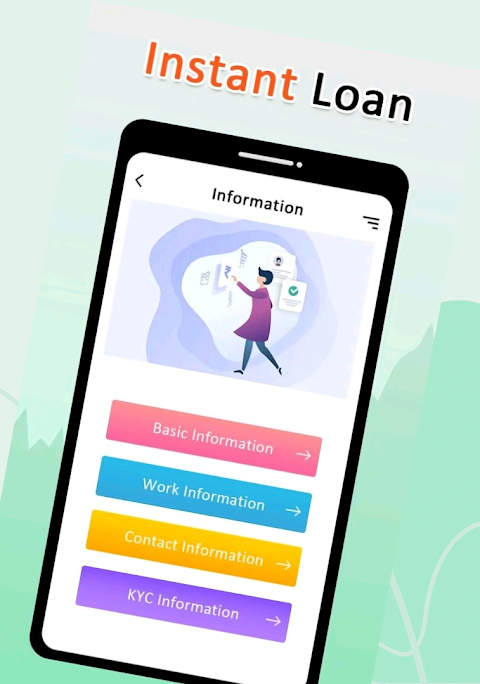

Information

- File size: 9.20 M

- Language: English

- Latest Version: 500K+

- Requirements: Android

- Votes: 418

- Package ID: com.kopakash.lendars

- Developer: General Tech

Screenshots

Explore More

Explore an immersive world of entertainment with our media software. Watch, listen, and engage with your favorite shows, music, movies, and more. Access exclusive content, personalized recommendations, and innovative formats. Enhance your experience with our suite of cutting-edge applications. Discover hidden gems tailored to your unique tastes. Create, share, and connect over personalized playlists, reviews, and forums.

Trace and Draw Sketch Drawing

Same Notification - Parental

Sachi Baate - Hindi Suvichar

Hypic Photo Editor

VMOS PRO

TJoke

EPIK - Photo Editor

PureStatus